18+ taxes on mortgage

Web Mortgage interest. Homeowners who bought houses before December 16.

En De Informatik Xlsx Slovarji Info

Web The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages.

. Web 23 hours agoHere are eight tips to help you have a smooth 2023 tax season. Web Here are Sallys itemized deductions for 2020. Answer Simple Questions About Your Life And We Do The Rest.

Calculating your mortgage recording tax is relatively straightforward. You can choose to deduct. If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent.

Veterans Use This Powerful VA Loan Benefit for Your Next Home. Web Here is an example of what will be the scenario to some people. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Web Need copy of 2018 taxes. Web This free mortgage calculator lets you estimate your monthly house payment including principal and interest taxes insurance and PMI. Ad Calculate Your Payment with 0 Down.

Try our mortgage calculator. However higher limitations 1 million 500000 if married. See how changes affect your monthly.

Therefore they are deductible. Web Are mortgage points tax deductible. If you have a mortgage and are curious about.

Homeowners have to pay these. Web Use Form 1098 Info Copy Only to report mortgage interest of 600 or more received by you during the year in the course of your trade or business from an individual. If you qualify for a.

The bank provided Form 1098 which listed the 7280 in loan interest. Ad Get an idea of your estimated payments or loan possibilities. As with property taxes you can deduct the interest on your mortgage for the portion of the year you owned your home.

My mortgage specialist needs it concerning house purchase - Answered by a verified Tax Professional We use cookies to give you. Web Minimum federal tax refund amount. Homeowners who are married but filing.

Five ways to avoid the extra tax. Ad Get an idea of your estimated payments or loan possibilities. Web You can deduct mortgage interest on the first 750000 of the loan or 375000 if youre married and filing separately if you took out the loan before Dec.

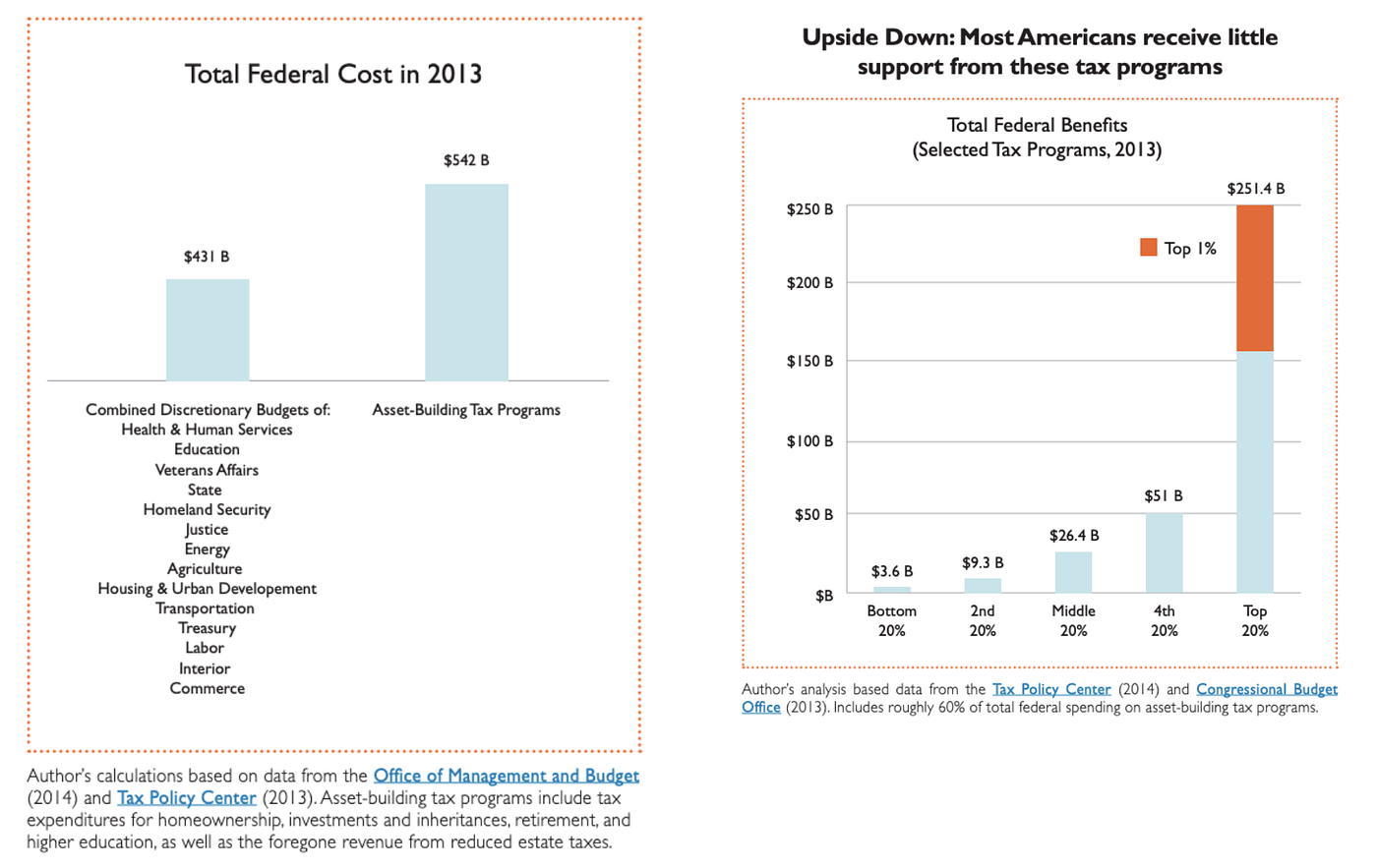

Starts at 85 if filing with a tax professional an additional fee applies for state returns Early Refund. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

State and local taxes. Web How to Calculate Your Mortgage Recording Tax. Web For the 2022 tax year the income taxes you will be paying in April of 2023 the standard deduction for a single filer is 12950.

Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. Web If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480. Organize Your Tax Documents and Financial Records Take time to organize your tax paperwork.

Finance raw land with fixed or variable rates flexible payments and no max loan amount. Take the principal of your mortgage which is. Mortgage points are a form of prepaid interest on a mortgage loan.

Web The filing deadline to submit 2022 tax returns or an extension to file and pay tax owed is Tuesday April 18 2023. The standard deduction for married. Web The amount is based on the assessed value of your home and vary depending on your states property tax rate.

Web The governments new super rules. Web Most homeowners can deduct all of their mortgage interest. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Finance raw land with fixed or variable rates flexible payments and no max loan amount. The 80000 Australians with superannuation balances above 3 million have two years to find. Try our mortgage calculator.

There are options to include extra payments or annual.

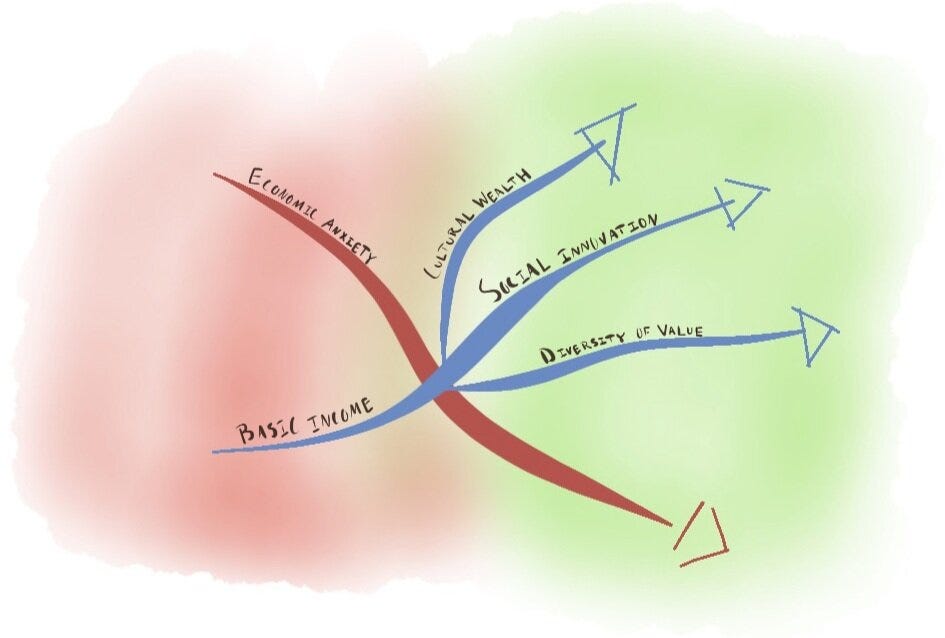

A Negative Income Tax For The 21st Century By Oshan Jarow Medium

Are Property Taxes Included In Mortgage Payments Smartasset

Tax Reform With 750k Cap On Mortgage Interest Deduction Would Leave 1 In 7 U S Homes Eligible Zillow Research

Property Taxes And Your Mortgage What You Need To Know Ramsey

Global Category Mngr Corporate Services Strategic Sourcing Efinancialcareers

A Negative Income Tax For The 21st Century By Oshan Jarow Medium

Homeowner Information For The Haf Program Wyoming Department Of Family Services

Aga Tax Solutions Home Facebook

Regions Next Step Survey Finds Americans Are Increasingly Pr

Tricks Of The Scammer Esl Efl Lesson Plan And Worksheet

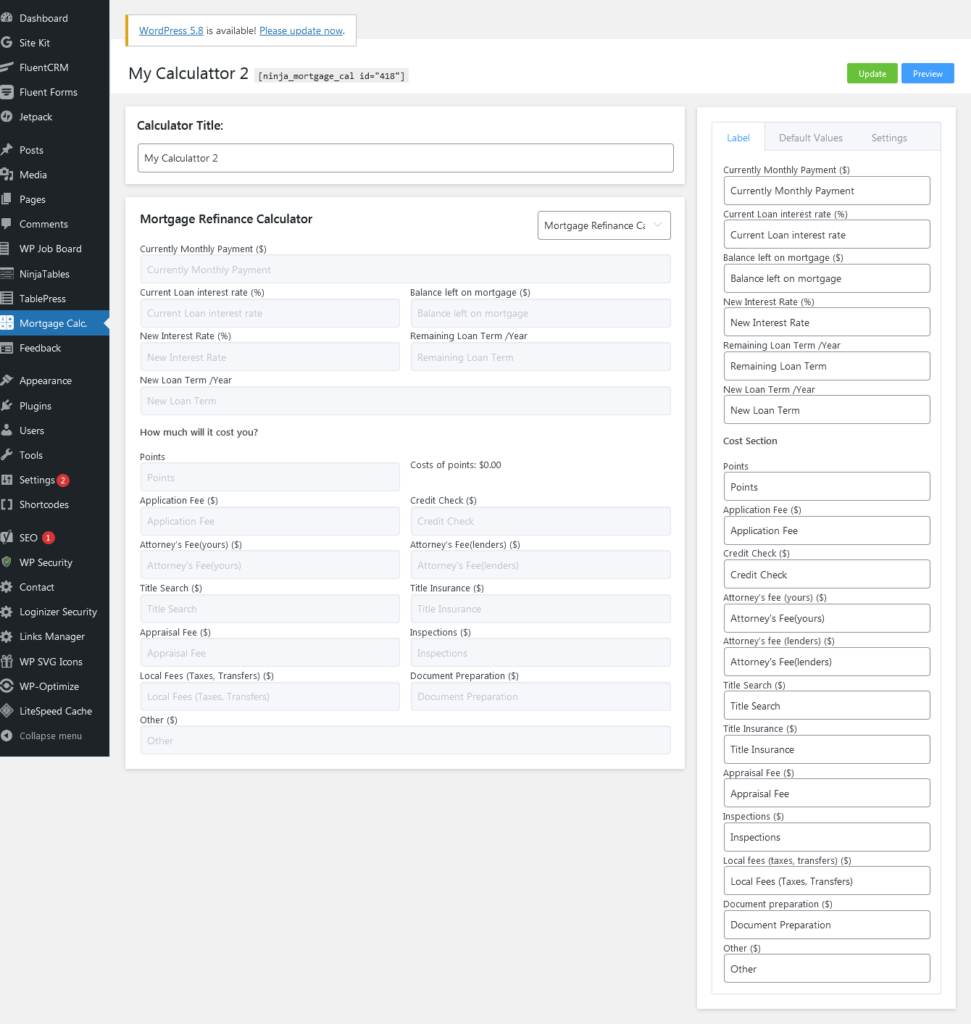

How To Calculate Mortgage On Your Site Using Mortgage Calculator Plugin

Regions Finds People Prefer Space Over Location In A New Home

Quiz Money Terms Worksheet

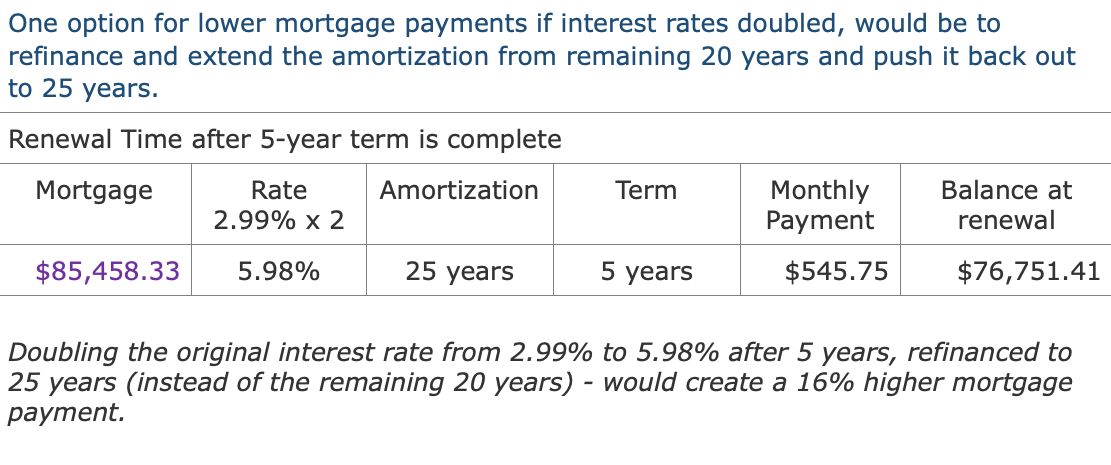

What Happens To My Mortgage Payment If Interest Rates Double

Free 3 Real Estate Loan Proposal Samples In Pdf

What Taxes Are Paid When Buying A House Genion Immobles

Immc Swd 282021 29170 20final Eng Xhtml 2 En Impact Assessment Part1 V4 Docx