Home value depreciation calculator

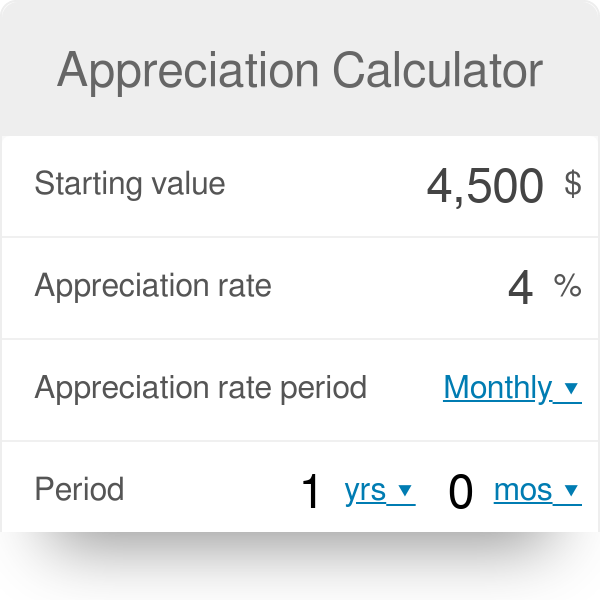

Your basis in your property the recovery period and the depreciation method used in real estate. The Home Value Appreciation Calculator computes annual appreciation rate of your home using homes purchase price and date and sales price and date.

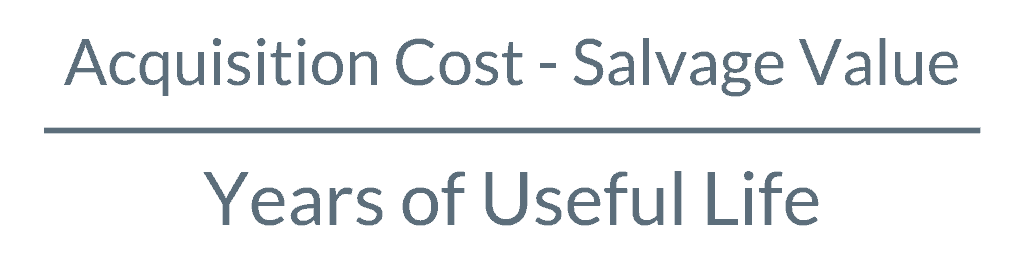

Depreciation Formula Calculate Depreciation Expense

Identify The Propertys Basis.

. Here is how to use a property depreciation calculator step-by-step. The next again year the depreciation value is 810 and so on. Subtract the fair market value of the land from the cost basis of the rental home because land is not subject to depreciation.

There are many variables which can affect an items life expectancy that should be taken into consideration when determining actual cash value. A P 1 R100 n. Knowing the estimated value of your own home helps you price your home for sale as a precursor to an official home appraisal.

How to Calculate Depreciation in real estate. It provides a couple different methods of depreciation. The negative rate is also known as a loss rate.

Sum-of-Years Digits Depreciation Calculator. Three factors help determine the amount of Depreciation you must deduct each year. Where A is the value of the home after n years P is the purchase amount R is the annual percentage.

7 6 5 4 3 2 1 28. Annual Depreciation Expense 2 x Cost of an asset Salvage ValueUseful life of an asset Or The double declining balance depreciation expense formula is. This valuation tool its free of charge.

Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae. The calculator should be used as a general guide only. Use a depreciation factor of two when doing calculations for double declining balance depreciation.

Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice the value of straight line depreciation for the first year. Last updated November 27 2020. Depreciation is an important element in the management of a companys assets.

To calculate the depreciation for a partial year multiply the depreciation of full-year with the number of months and then divide it by 12. Depreciation Calculator For Home Office Internal Revenue Code Simplified. Determine the basis of the property.

The calculator should be used as a general guide only. AssetColumn connects all the available websites online asking for a value of your property with your property address the final value of your Home is an algorithm with a mix of all them into a final one. A calculator to quickly and easily determine the appreciation or depreciation of an asset.

Depreciation in Any Full year Cost Life Partial year depreciation when the property was put into service in the M-th month is taken as. For every full year that a property is in service you. Depreciation amount book value.

Some items may devalue more rapidly due to consumer preferences or technological advancements. Our Home Calculator is the most reliable home calculator online but still its just an estimator. The rate is positive when sales price exceeds the purchase price and negative when purchase price exceeds the sales price.

Next determine the amount that you can depreciate each year. For residential household. Depreciation Expense 2 x Cost of the asset x depreciation rate.

Check out the percentage increase of your home value with this calculator. Cost of asset salvage valueestimated useful life annual depreciation expense 600 1005 100 in annual depreciation expenses As for the residence itself the IRS requires you to. Step one - Calculate the depreciation charge by using below given formula Depreciation charge per year Asset value - Residual value x Depreciation percentage 3000 - 1000 x 15.

A 250000 P 200000 n 5. For example if you purchased a rental home for 270000 and the land on which it sits is worth 30000 then you will be. Instead it projects what a given house purchased at a point in the time would be worth today if it appreciated the average appreciation rate of surrounding homes.

Original Purchase Price Initial Value. Calculate the average annual percentage rate of appreciation. Understanding your homes worth allows you to estimate the proceeds of a future home sale so you can get a better estimate your budget for your next homeAnd if youre shopping its also useful to check the value of homes in the area to ensure.

The FHFA has a house price calculator to estimate home values. The value of the home after n years A P 1 R100 n Lets suppose that the multiplying factor is k 250000 200000 k 5 k 250000 200000 15 10456 10456 1 R100 10456 1 100 456. It provides a couple different methods of depreciation.

Depreciation Amount Asset Value x Annual Percentage Balance Asset Value -. The cause of the property is its cost or the amount you paid to acquire it. Designed for mobile and desktop clients.

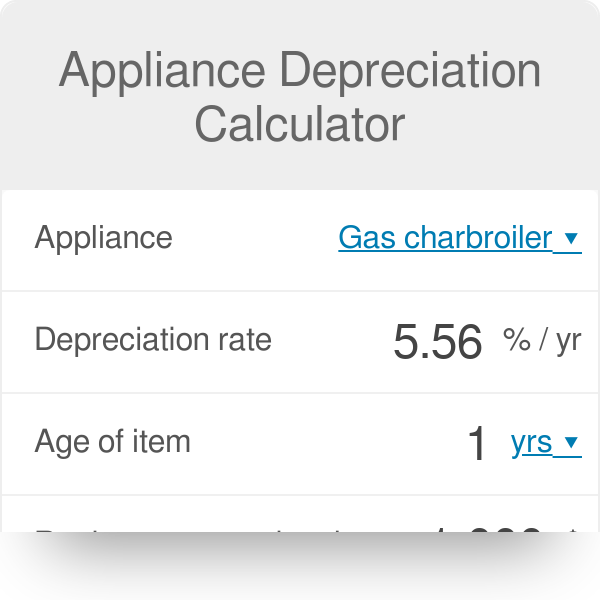

There are many variables which can affect an items life expectancy that should be taken into consideration when determining actual cash value. Depreciation Calculator This depreciation calculator is for calculating the depreciation schedule of an asset. As most residential rental property uses GDS well focus on that calculation.

First year depreciation 12-M05 12 Cost Life Tax Forms Reference Form 4562 IRS 2009 Depreciation and Amortization Including Information on Listed Property. Use other online resources. Identify the propertys basis Separate the cost of land and buildings Determine your asset depreciation method Divide the basis by the duration of depreciation Calculate adjusted basis 1.

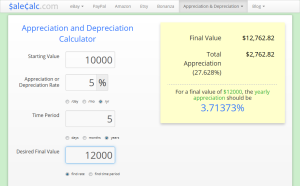

First one can choose the straight line method of depreciation. Finds the daily monthly yearly and total appreciation or depreciation rates based on starting and final values. Real Estate Property Depreciation Calculator Calculate depreciation used for any full year and create a depreciation schedule that uses mid month convention and straight-line depreciation for residential rental or nonresidential real property related to IRS form 4562 lines 19 and 20.

Enter the original purchase price of your home and current estimated value to find out the the Annual Home Value Appreciation percentage. Note that the calculator does NOT project the actual value of any particular house. With this method depreciation is calculated equally each year during the useful life of the asset.

Some items may devalue more rapidly due to consumer preferences or technological advancements.

Appreciation Depreciation Calculator Salecalc Com

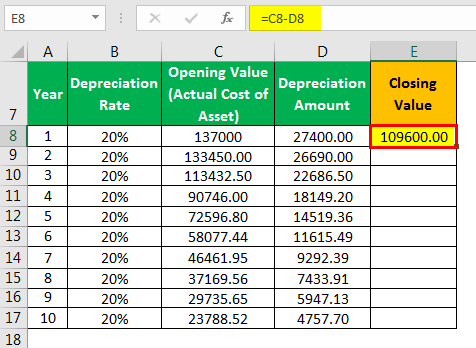

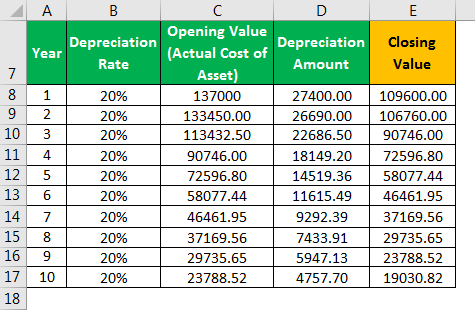

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

Appliance Depreciation Calculator

Sum Of Years Depreciation Calculator Double Entry Bookkeeping

How To Use The Excel Db Function Exceljet

How To Use Rental Property Depreciation To Your Advantage

Straight Line Depreciation Calculator And Definition Retipster

Free Macrs Depreciation Calculator For Excel

Straight Line Depreciation Calculator And Definition Retipster

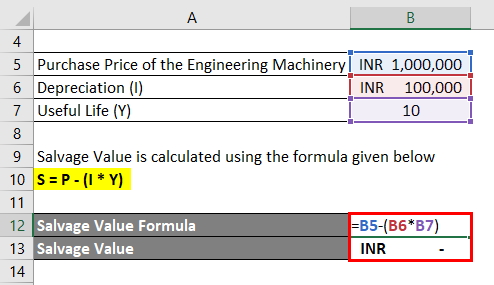

Salvage Value Formula Calculator Excel Template

Depreciation Expense Double Entry Bookkeeping

Appreciation Calculator

Straight Line Depreciation Calculator Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense